- Loans

- Business Loans

- Unsecured Business Loans

- Secured Business Loans

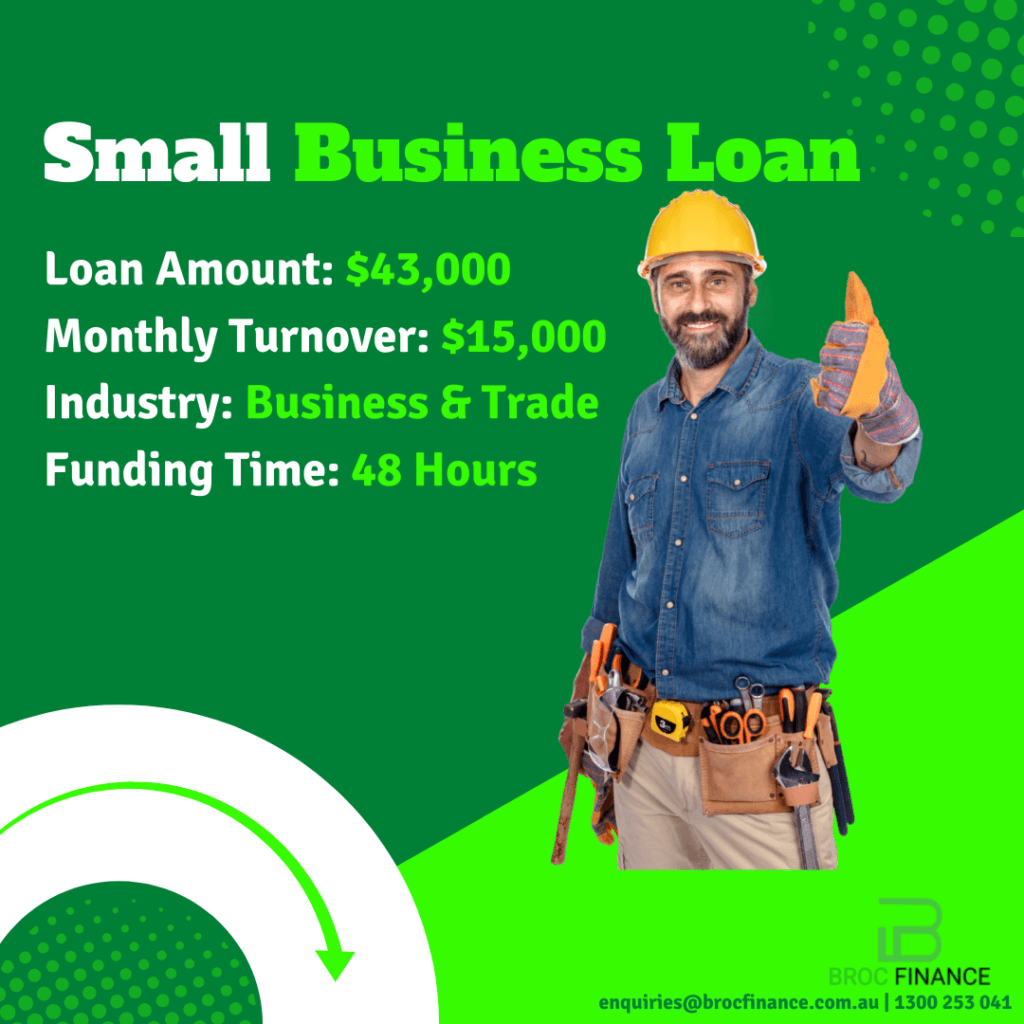

- Small Business Loans

- Business Line of Credit

- ATO Tax Debt Loans

- Cash Flow Finance

- Business Overdraft

- Debtor Finance

- Invoice Finance

- Invoice Discounting

- Invoice Factoring

- Working Capital Loans

- Trade Finance

- Bad Credit Business Loans

- Quick Business Loans

- Startup Business Loans

- Short Term Business Loans

- Low Doc Business Loans

- Supply Chain Finance

- Asset Finance

- Property Finance

- Business Loans

- About

- Success Stories

- Partner With Us

Menu